FGF E-Package

A Voice from Fly-Over Country

December 1, 2009

What’s Our Real Federal Income

Tax Rate?

by Robert L. Hale

MINOT, NORTH DAKOTA — Americans who work for a living, pay their taxes, and keep their personal and family budgets in check must find the irresponsibility of Congress unbearable. If they do not, it could well be because they choose to ignore the gross mismanagement of their elected representatives and senators.

The Congressional Budget Office (CBO) tells us that average American taxpayers pay 22 percent of their income in federal income taxes. What the CBO data do not tell us is what rate would be needed if income taxes were set at a rate to ensure that collections fund federal spending each year.

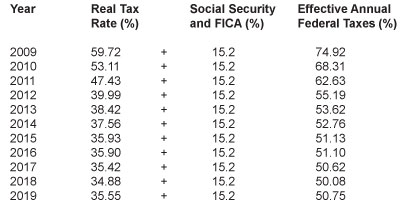

The Office of Management and Budget (OMB), however, provides the data to determine what our tax bill would be if the federal government’s budget were required — as our family budgets are — to be balanced. This chart shows the individual income tax rate required to maintain a balanced budget for each of the following years, as well as the Social Security and FICA amounts taken from our paycheck by the federal government:

This rate is what would be required to stop increasing the federal debt, which is now almost $13 trillion. The reality is that the federal government is playing games with our earning power and prosperity as well as those of our children and grandchildren.The OMB projects that, by 2019, the federal debt will reach more than $23 trillion. Actually, this is not likely to happen because foreign countries have already begun to pull back and stop buying our debt. The amount of total federal income used to fund the federal debt annually is projected to be $829 billion by 2019, almost the total individual income tax collections in 2009!

The OMB projections also assume that debt growth, tax increases, and entitlements will not have a negative impact on productivity. Yet history tells us that this type of irresponsible fiscal management by government has only one outcome -- the demise and eventual collapse of an economy.

A family budget may, from time to time, incur expenses beyond its income, but the family knows the deficit cannot be sustained. Accordingly, the family reduces spending and works harder. The federal government, which fails to acknowledge the inescapable consequences of indefinite borrowing and spending, refuses to cut spending. The consequences of this irresponsibility are beginning to be evident. The value of the dollar compared to other currencies is sagging and soon will break. Sooner rather than later there will be fewer lenders, and taxpayers will have little left that the government can take.Those of us who actually work and add to the prosperity of our economy are the only ones that government can tax to fund its irresponsibility. At some point, each of us will have to ask why we should continue. When too much is confiscated, the incentive to produce ends. Producing is simply is not worth the effort. The “golden goose” is being butchered at the altar of government irresponsibility and greed.

On October 30, 2009, U.S. Secretary of State Clinton blasted the Pakistani government for not imposing higher taxes on its citizens. She said, “The percentage of taxes on GDP in Pakistan is among the lowest in the world. We in the United States tax everything that moves and doesn’t move, and that’s not what we see in Pakistan.” This speaks volumes for what those we have elected to govern our nation think of those of us who have created our nation’s prosperity.

An elite “governing class” — which squanders our precious earnings and the future work effort of our children -- needs to be removed. The sooner the better.

A Voice from Fly-Over Country archives

A Voice from Fly-Over Country is copyright © 2009 by Robert L. Hale and the Fitzgerald Griffin Foundation. All rights reserved.

Robert L. Hale received his J.D. in law from Gonzaga University Law School in Spokane, Washington. He is founder and director of a non-profit public interest law firm. For more than three decades he has been involved in drafting proposed laws and counseling elected officials in ways to remove burdensome and unnecessary rules and regulations.

See a complete biographical sketch.

To subscribe or donate to the FGF E-Package online or send a check to:

Fitzgerald Griffin Foundation

344 Maple Avenue West, #281

Vienna, VA 22180

1-877-726-0058

publishing@fgfbooks.com

@ 2025 Fitzgerald Griffin Foundation